Explore our blog featuring articles about farming and irrigation tips and tricks!

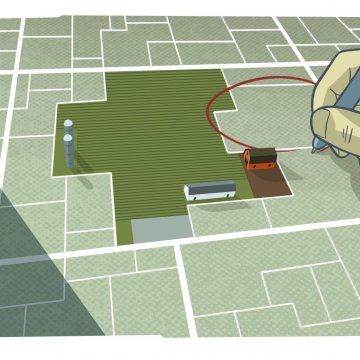

New Dirt Under The Old Plan

By: Mark McLaughlin

My husband and I are 76, farm with our son, own 840 acres debt-free, and just did something we promised we wouldn’t do. We took on debt to buy another 160 acres right next to us. I thought we were done! Our son wanted to buy it, but his balance sheet was maxed out.

We did our farm plan eight years ago. Our wills give our land to our farming son. In turn, he is paying for an insurance policy on us that goes to our two off-farm heirs. We based the amount of insurance on $7,000 an acre, which seemed high back then! Everyone agreed at the family meeting that having a “farm bucket” and a “nonfarm bucket” made sense. We still do. The problem: We paid $10,000 an acre for the new farm. Now our off-farm son thinks we should redo the whole plan based on current values. Our daughter’s quiet, but our farming son is stressed because the goal line could move. I’m afraid this new purchase (and debt) could derail our farm succession strategies. How can we best fit our new land into our old plan?

Stay up to date on all T-L news and get alerts on special pricing!